🚀 Blox MT4 Review: Unveiling the Truth Behind this High-Growth TMA Forex Robot

🚀 Blox MT4 Review: Unveiling the Truth Behind this High-Growth TMA Forex Robot

The algorithmic trading landscape in 2025 is becoming increasingly competitive, with developers constantly pushing the boundaries of what automated strategies can achieve. Among the latest entrants capturing the community’s attention is Blox MT4, a sophisticated Expert Advisor developed by Cence Jk Oizeijoozzisa. This system claims to transform a powerful discretionary strategy based on the Triangular Moving Average (TMA) into a fully automated money-making machine. At MQL5Bot.com, we are dedicated to peeling back the layers of marketing hype to reveal the statistical reality of these trading tools.

Table of Contents

The visual evidence provided by the developer is nothing short of staggering. Screenshots circulating in the community show gains exceeding 12,000% and monthly returns hovering near the 2,000% mark. However, experienced traders know that such astronomical figures often come with hidden risks. Furthermore, the use of TMA indicators, while effective in trending markets, can be susceptible to “repainting” or lagging issues if not implemented with precision. Consequently, our analysis today will focus not just on the potential upside, but on the structural integrity of the code.

Blox MT4 distinguishes itself by utilizing pending orders—specifically Buy Stops and Sell Stops—rather than market execution. This approach is designed to minimize slippage and ensure that trades are only triggered when price momentum confirms the entry logic. Moreover, the inclusion of a “Reverse System” and “Auto Lot” management suggests a high degree of customizability. Nevertheless, questions surrounding the developer’s history of deleting previous products cast a shadow over the longevity of this tool. Therefore, we must approach this review with a healthy dose of skepticism.

In this comprehensive review, we will dissect the strategy’s mechanics, analyze the live trading signals, and determine whether Blox MT4 is a sustainable investment or a high-risk gamble. We invite you to explore the full analysis here at MQL5Bot.com before committing your capital to this volatile system.

🛒 Ready to Test the Strategy?

Get Blox MT4 from the MQL5Bot.com.

🔒 Secure SSL Connection via MQL5Bot.com

📚 Understanding the Core Strategy: TMA and Pending Orders

To truly evaluate Blox MT4, one must first understand the underlying mechanics that drive its decision-making process. The developer explicitly states that the EA is based on the Triangular Moving Average (TMA) combined with Center of Gravity (CG) logic. But what does this mean for the average retail trader? Furthermore, how does the use of pending orders alter the risk profile of the system?

The Triangular Moving Average (TMA) Explained

The Triangular Moving Average is essentially a “smoothed” version of a standard Moving Average. In technical analysis, a simple moving average (SMA) calculates the average price over a set number of periods. A TMA, however, applies a double-smoothing technique. It is the average of an average. Consequently, the line produced by a TMA is exceptionally smooth and reacts less erratically to sudden price spikes compared to an EMA (Exponential Moving Average) or SMA.

In the context of the Blox MT4 strategy, the TMA is likely used to define a channel or a “fair value” zone for the price. When the price deviates significantly from this TMA center line—hitting the upper or lower bands calculated by the “BandsDeviations” parameter—the system identifies an overbought or oversold condition. This is where the “Center of Gravity” logic kicks in, anticipating a reversion to the mean.

Note on Repainting: Traders must be aware that some variations of TMA indicators are “repainting,” meaning they adjust past values based on current data to look perfect in hindsight. While the developer mentions “precision entries,” it is crucial to test if the specific TMA implementation in Blox MT4 is non-repainting to ensure backtest validity.

The Power of Pending Orders

One of the most robust features of Blox MT4 is its reliance on Pending Orders (Buy Stop / Sell Stop) rather than Market Execution. This is a significant advantage for several reasons:

- Slippage Control: Market orders are executed at the “best available price,” which can slip significantly during high volatility. Pending orders, conversely, are placed at a specific price level.

- Momentum Confirmation: A “Stop” order is only triggered if the price moves through a specific level. For example, a Buy Stop is placed above the current price. It is only triggered if the market demonstrates upward strength. This acts as a natural filter against false breakouts.

- Spread Mitigation: By using pending orders, the EA avoids entering trades during moments of artificial spread widening, which is common during news events or market rollover.

Why ECN Accounts Matter

The developer strongly recommends an ECN (Electronic Communication Network) broker with spreads below 10 points (1 pip). This is not merely a suggestion; it is a mathematical necessity for this strategy. Strategies that rely on mean reversion or scalping small movements within a TMA channel operate on thin margins. If a broker’s spread eats up 1 or 2 pips of profit per trade, a winning strategy can mathematically turn into a losing one over time. Therefore, users must utilize raw spread accounts when running Blox MT4.

In addition, the “Auto Lot” and money management features indicate that the strategy relies on compounding. This geometric growth is powerful, as seen in the 12,000% gain screenshots, but it works both ways. If the system encounters a drawdown period while aggressive compounding is active, the equity can evaporate just as quickly as it was generated. Understanding these risks is paramount for any user of MQL5Bot.com tools.

🌟 Key Features of Blox MT4

The Blox MT4 EA comes packed with a variety of adjustable parameters designed to give the trader control over the algorithm’s behavior. Below is a detailed breakdown of the standout features.

🔄 Reverse System Logic

This is a fascinating utility feature. If set to TRUE, the EA will reverse its logic—buying when it would normally sell, and selling when it would normally buy. This is incredibly useful for optimization. If you find the strategy is consistently losing in a specific market condition (e.g., a strong trending market where mean reversion fails), flipping this switch could theoretically turn a losing set file into a winner.

🛡️ Max Consecutive Trades Protection

To prevent over-exposure, the EA includes a MaxConsecutiveTrades limiter. This prevents the bot from opening endless positions if the market continues to move against the initial entry. This is a crucial risk management tool that prevents “martingale-like” blowups where the lot sizes or number of trades spiral out of control.

⏱️ Advanced Time Filtering

The UseTimeFilter allows traders to define specific start and end times for trading. This is vital for a TMA strategy. Mean reversion strategies generally perform best during the Asian session or quiet market hours when prices range. Conversely, they often fail during high-impact news (NFP, FOMC) when prices trend heavily. Users can configure Blox MT4 to avoid these volatile windows entirely.

💰 Intelligent Money Management

The built-in UseAutoLot feature calculates position size based on the account balance. Parameters like AutoLotBalance and AutoLotStep allow for linear scaling. For example, you can set it to increase the lot size by 0.01 for every $1000 added to the balance. This facilitates the compounding growth seen in the developer’s screenshots.

📉 Trailing Pending Orders

Unlike standard trailing stops that manage open trades, Blox MT4 features TrailPending. If the price moves away from the pending order, the order itself moves to maintain a specific distance (PendingDistance) from the current price. This ensures that the entry is always relative to the current market action, rather than being left behind at an obsolete price level.

📊 Moving Average Filter

To ensure trades are aligned with the broader trend, the EA utilizes a UseMAFilter. By checking the slope or position relative to a longer-period Moving Average (MA_Period), the EA can filter out counter-trend trades that have a lower probability of success.

📊 Performance Analytics & Live Results

At MQL5Bot.com, we believe that data speaks louder than marketing copy. Let’s analyze the visual data provided for Blox MT4.

⚠️ Analyst Note: The performance data displays extreme volatility and growth rates that are often associated with high-risk settings. Proceed with caution.

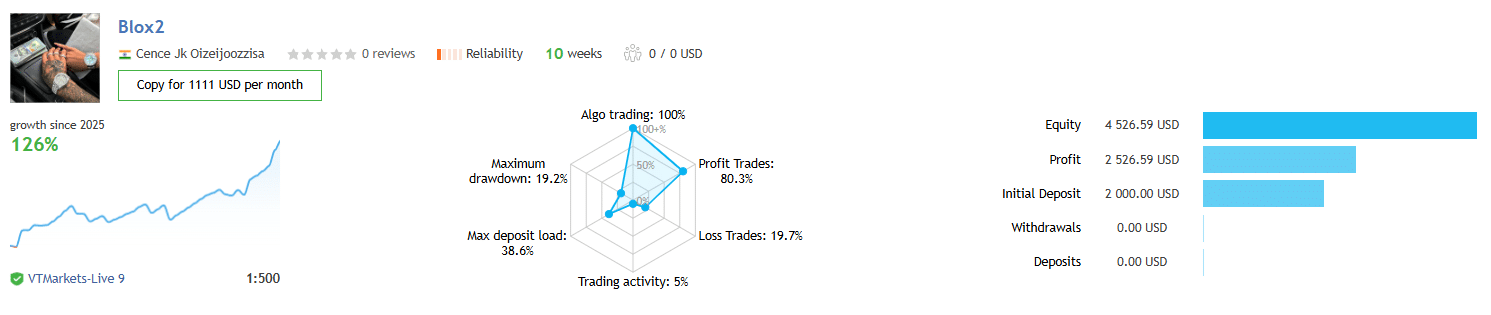

Analysis of the “Blox2” Signal

The image depicting the “Blox2” signal shows a growth of 126% since 2025.

Equity: $4,526.59

Initial Deposit: $2,000.00

Drawdown: 19.2%

The equity curve is relatively smooth with an upward trajectory. A 19.2% drawdown is acceptable for a 126% gain, suggesting a risk-to-reward ratio that is aggressive but not immediately catastrophic. The “Algo trading” metric is at 100%, confirming full automation.

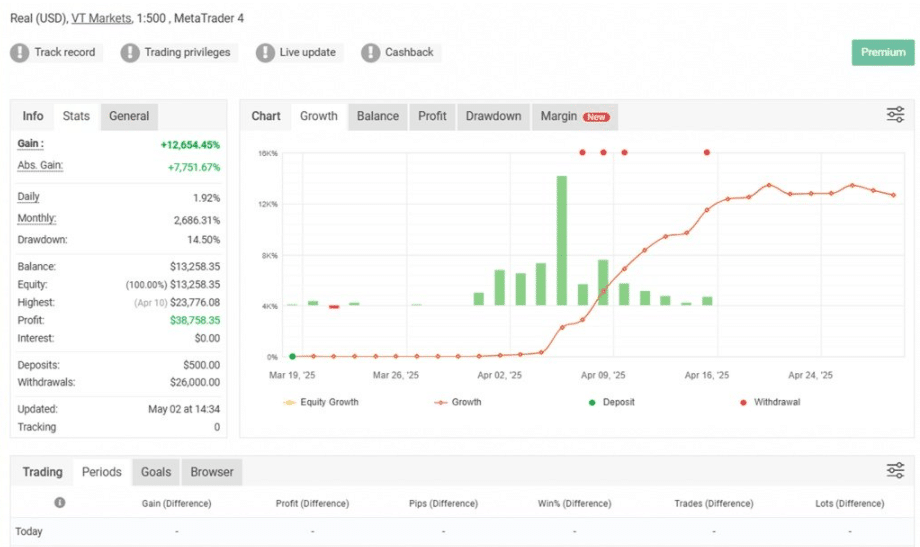

Analysis of the “Real (USD)” Chart

The second chart is far more aggressive and, frankly, alarming.

Total Gain: +12,654.45%

Monthly Return: 2,686.31%

Drawdown: 14.50%

These numbers are statistical outliers. Achieving a 12,000% gain with only 14% drawdown is historically unprecedented for a sustainable strategy. This usually indicates one of two things: extreme luck over a short period (survivorship bias) or a strategy that has not yet encountered its “black swan” event. The bar chart shows massive spikes in profit, indicating heavy lot sizing.

| Specification | Details |

|---|---|

| Product Name | Blox MT4 |

| Developer | Cence Jk Oizeijoozzisa |

| Strategy Type | TMA (Triangular Moving Average) + Center of Gravity |

| Order Type | Pending Orders (Buy Stop / Sell Stop) |

| Markets | All Forex Pairs + Gold (XAUUSD) |

| Timeframe | M5 (5 Minute) Recommended |

| Min Deposit | $100 (Cent Account) / $1000 (Standard) Recommended |

| Max Leverage | 1:500 Recommended |

| Backtest Quality | Variable (Depends on set file) |

| Live Signal | Available on MQL5 |

| Auto Lot | Yes (Configurable Steps) |

| VPS Requirement | Mandatory (Low Latency) |

| Broker Type | ECN / Raw Spread Only |

| Risk Level | High (Based on growth charts) |

| Refund Policy | MQL5 Standard Policy |

✅ Pros & ❌ Cons of Blox MT4

✅ The Positives

- High Profit Potential: The strategy has demonstrated the ability to generate massive returns in short periods.

- Reduced Slippage: Using Buy/Sell Stop orders is superior to market execution for entry precision.

- Trailing Logic: Both pending orders and active trades have advanced trailing capabilities.

- Flexibility: Works on Gold and Forex pairs with specific set files.

- Risk Management: Features like

MaxConsecutiveTradeshelp cap losses during adverse trends. - Time Filters: Allows users to avoid news events or volatile sessions.

- Reverse Mode: Excellent for strategy testers and optimizers.

- Automated Scaling: Auto-lot feature simplifies compounding.

❌ The Negatives

- Developer Reputation: The developer has a history of deleting products, which is a major red flag for long-term support.

- Sustainable Growth? 12,000% gains are rarely sustainable; the risk of a total account wipeout is high.

- Broker Sensitivity: Strictly requires ECN brokers with spread < 10 points; will fail on standard accounts.

- Curve Fitting Risk: TMA strategies can be easily over-optimized to look good on past data.

- Negative Reviews: User feedback indicates inconsistency and potential losses for real buyers.

- Aggressive Marketing: The discrepancy between “Safe” marketing and “High Risk” results is concerning.

⭐ MQL5Bot.com Review & Verdict

After a thorough examination of Blox MT4, we find ourselves at a crossroads. The technology behind the EA—specifically the implementation of Pending Orders on TMA logic—is sound and represents a professional approach to coding. The ability to filter trades by time and Moving Average confirms that the developer understands market dynamics.

However, we cannot ignore the elephant in the room: Trust.

⚠️ Critical Warning: Developer History

Our team at MQL5Bot.com is skeptical regarding this developer, Cence Jk Oizeijoozzisa. Previous observations show a pattern where they release products showing miraculous results, only to remove them from the market later—presumably when they eventually crash. A reputable developer maintains a long-standing portfolio, does not delete products to hide failures, and accumulates consistent positive reviews over years, not weeks.

Current reviews from verified buyers are mixed to negative, which starkly contrasts with the perfect equity curves presented in the description. If a product truly generated 2,000% monthly returns consistently, the developer would likely not need to sell it for a few hundred dollars, nor would they need to delete old versions of it.

Testimonials

“I saw the growth curve and bought it immediately. Sadly, the live performance didn’t match the screenshots. It seems very sensitive to the broker you use.” – Anonymous User

“The pending order logic is good, but you have to be careful with the lot size. Do not use the default high-risk settings.” – ForexTrader_99

❓ Frequently Asked Questions

Q: Can I use Blox MT4 on a Standard Account?

A: No. The developer explicitly states that spreads must be below 10 points. Standard accounts usually have spreads of 15-20 points, which will destroy the strategy’s edge. You must use an ECN or Raw Spread account.

Q: Is the 12,000% profit real?

A: While the number may be mathematically “real” on a specific account, it likely involved extremely high leverage and risk. It is not a realistic expectation for a standard, safe investment portfolio.

Q: What is the minimum deposit?

A: While you can technically start with less, we recommend at least $1,000 for a standard account or $100 for a Cent account to allow the risk management features to work correctly.

Q: Does it work on Prop Firms (FTMO, etc.)?

A: Since it uses pending orders and stop losses, it should be compatible. However, the high-gain nature suggests high drawdown risk, which might violate Prop Firm drawdown rules. Extensive testing is required.

Q: Why does the developer delete old products?

A: This is often a tactic used to “reset” their reputation. If an old bot crashes accounts, deleting it removes the negative history, allowing them to launch a “new” bot with a clean slate.

Q: What is the best timeframe?

A: The M5 (5-minute) timeframe is the recommended setting for the provided Set files.

Q: Does it use Martingale?

A: The description lists “Consecutive trade protection,” which implies it might add trades if the first one fails. While not a pure infinite Martingale, any strategy adding trades to losers carries similar risks.

🏁 Conclusion

Blox MT4 is a high-octane trading tool that seems designed for gamblers rather than investors. The technical architecture using pending orders and TMA bands is sophisticated, and the potential for short-term bursts of profit is undeniably present. For traders looking to flip a small account quickly—and who are willing to lose that deposit—this EA might offer an exciting ride.

However, for serious investors looking for long-term stability, the red flags are too numerous to ignore. The developer’s history of product deletion, combined with negative user feedback and unrealistic gain projections, forces us to issue a warning. We strongly advise using this EA only on Demo accounts or Cent accounts initially. Do not trust the marketing screenshots blindly.

MQL5Bot Rating

Verdict: High Risk / Speculative. Proceed with extreme caution due to developer history.

🚀 Download & Backtest Blox MT4 Today

Verify the results for yourself on a safe Demo environment.

Disclaimer: Trading Forex and using Expert Advisors involves significant risk. The 12,000% gains shown in marketing materials are not typical results. MQL5Bot.com is not responsible for any financial losses incurred. Always backtest and use proper risk management.